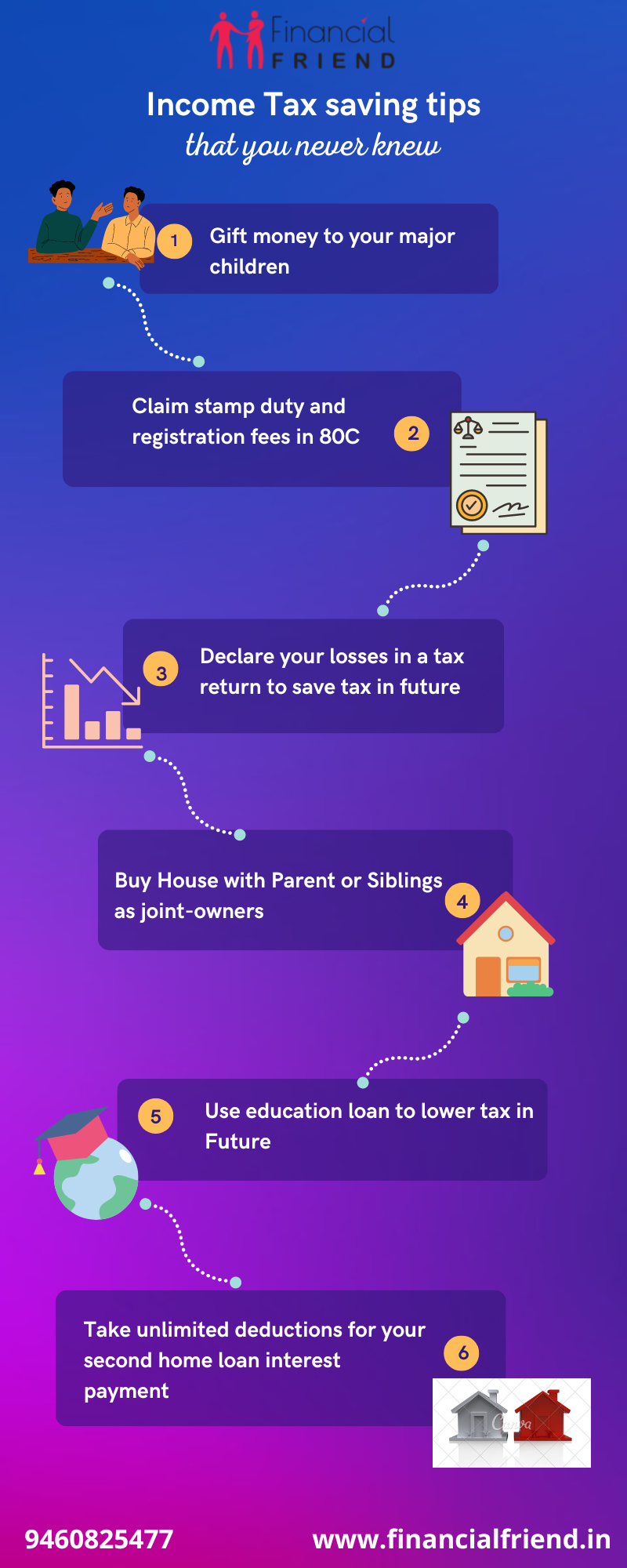

The last date for filing your income tax return is arriving soon i.e, 31st July. And, you must be looking for some unique and legal ways to save tax. So, here we are with income tax saving tips for you.

Income Tax saving tips

1. Gift money to your major children and Save tax as their money will become theirs & any income arising out of it would be treated as their income, not yours. In case their income is below the limits, there won’t be any tax.

2. Claim stamp duty and registration fees in 80C Many people don’t know this, but the Stamp duty and the registration fees of the documents for the house can be claimed as deduction under section 80C in the year of purchase of the house.

3. Get deduction for rent even without HRA – Under Section 80GG, you can claim a deduction of the rent paid even if you don’t get HRA. However, not many people are aware of this deduction. If you are not being paid any HRA or don’t have any housing benefits from the employer. You can claim least of following 3 things as HRA

a) Rent paid less 10% of total income

b) or Rs 2,000 a month;

c) or 25% of total income.

4. Declare your losses in a tax return to save tax in future – A lot of people do not show their losses in shares, mutual funds, gold ETFs, real-estate in their tax returns. This is a big mistake, as you lose an opportunity to save tax in future years. You can set-off your losses against profits in the current year as well as in the future too.

5. Buy House with Parent or Siblings as joint-owners – You can have your spouse/parent/siblings as co-owner and all the co-owners can claim the tax deductions of 1 lacs for principal and 1.5 lacs for interest part.

6. Use education loan to lower tax for your Children in Future – It would be wise to opt for an education loan in the name of your children’s name as you can claim the full interest paid on education loan under section 80E

7. Take unlimited deductions for your second home loan interest payment – For the first house you can claim up to 1.5 lacs in interest, however for your second house you can claim the full amount of interest without any upper limit.

File your income tax return at just Rs500/-