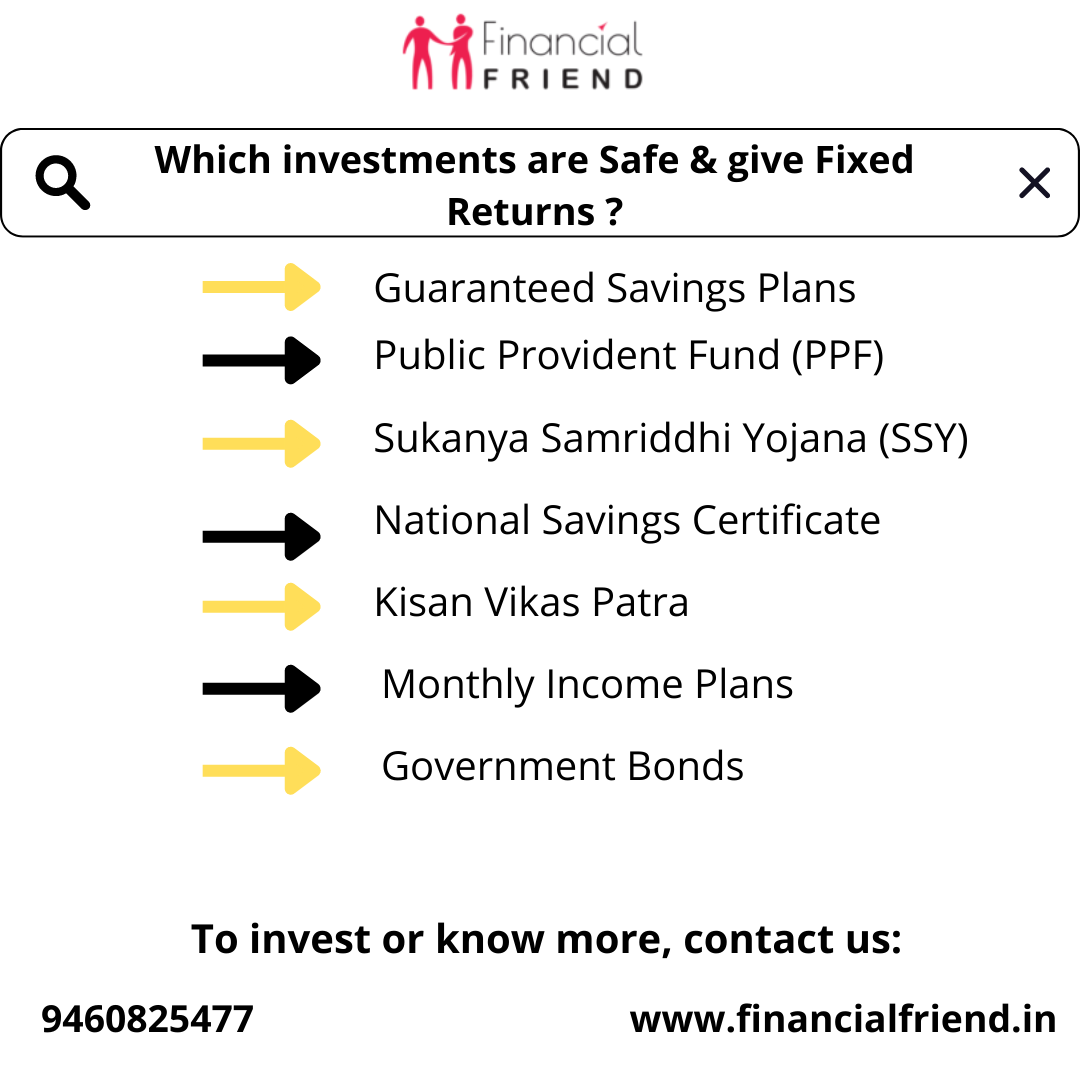

Are you looking for investment options that are safe and also give fixed income ?. If yes, then here we are with the best and safe investment options. These fixed income securities will generate wealth while keeping your capital investment safe.

1. Guaranteed Savings Plans

Guaranteed savings plans are safe investment plans from life insurance companies. Investment in these plans is tax-deductible under section 80C and the maturity value is tax-free. These plans guarantee a minimum return on your investment. So, you have a chance to earn higher, but your returns will not drop below the minimum guaranteed amount.

2. Public Provident Fund (PPF) & Sukanya Samriddhi Yojana (SSY)

Both PPF and SSY carry similar investment and return profiles. The only difference is that anyone can open a PPF account and only one PPF account. However, only a legal guardian or parent of a girl child can open one SSY per child for up to two girls.

So, if you are looking after a girl child financially you can open one PPF and one SSY account. The maximum investment in both instruments is limited to Rs. 1.5 lakhs. Both investments offer tax-free maturity value.

3. National Savings Certificate (NSC VIII)

National Savings Certificate of NSC VIII-issue is another popular tax saving instrument with guaranteed returns. The returns on new issues are revised at the beginning of every financial year.

4. Kisan Vikas Patra (KVP)

KVP investment also offers a fixed guaranteed rate of return, which is revised every financial year. However, unlike NSC and other investments, KVP does not have a definite maturity period. You can hold KVP until your money investment doubles.

5. Bank or Post Office Fixed & Recurring Deposits

Bank and post office fixed deposits have been the oldest guaranteed investment schemes in India. You can opt for various maturities with fixed and recurring deposits.

6. Monthly Income Plans

Under these plans, investors receive a regular monthly income in the form of dividends. The rate of return generally fluctuates between 8% and 9%. Additionally, dividends paid are tax-free.

7. Government Bonds

Government bonds are just as stable as FDs. A bond is a debt instrument, which is secured by the government itself and has a fixed rate of interest attached to it as well.

8. RBI Taxable Bond

This is another guaranteed return investment plan option, which comes with a tenure of 7 years and offers an interest rate of 7.75% per annum. RBI taxable bonds are issued only in Demat mode and are credited in the investor’s Bond Ledger Account (BLA).

If you wish to know more about these fixed income securities, feel free to contact us at +91 9460825477