What are Multi Asset Funds ?

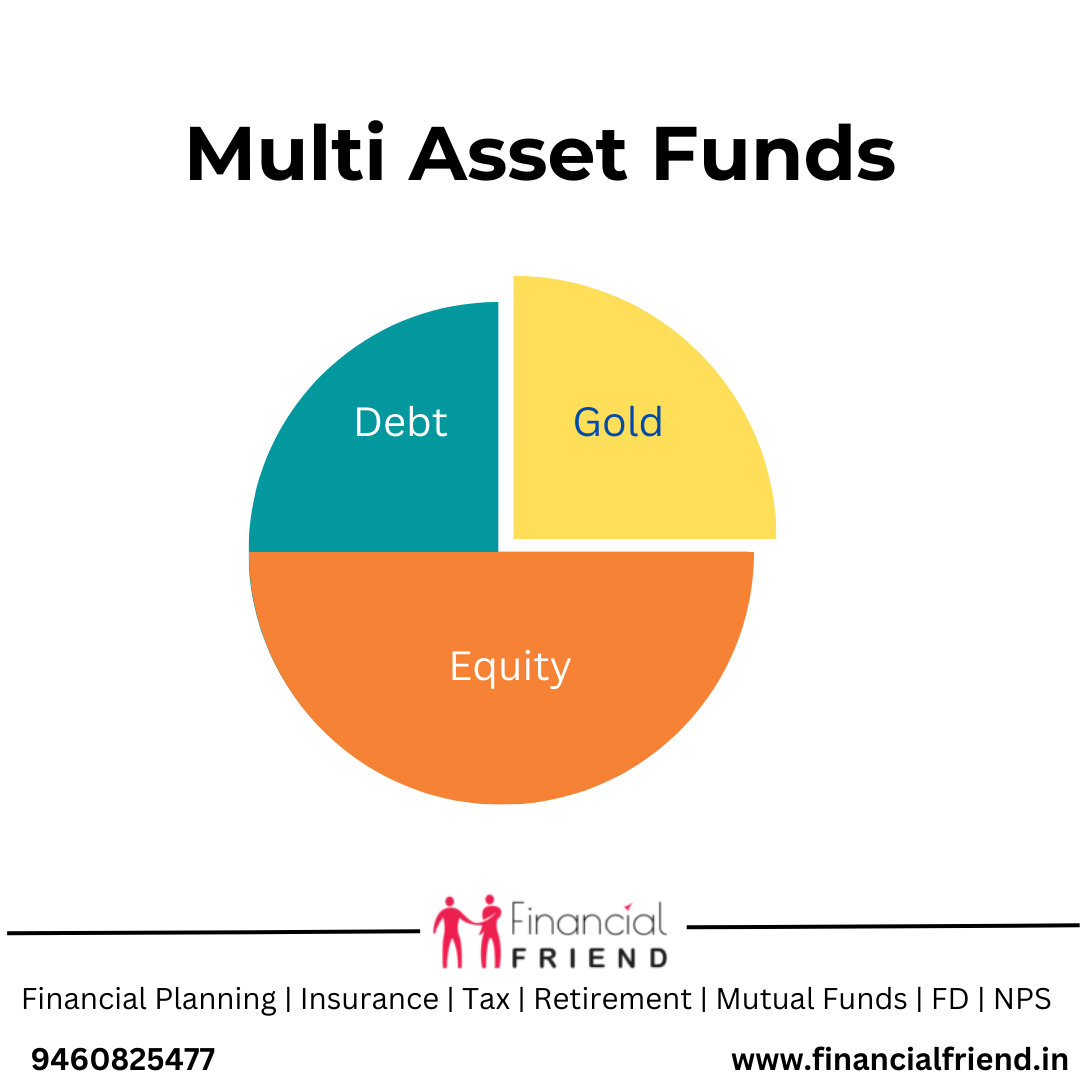

Multi Asset Funds, as the name suggests are those mutual funds which allocate the investments in multiple asset classes that are, equity, debt, gold, real estate etc.

How Multi Asset Fund beat market ups and downs ?

In the ongoing business sector situation, all asset classes are unpredictable. Equity markets are unstable, Bond yields are going up, and gold is at its peak. Research has shown that over the long period, an appropriately diversified portfolio will give you ideal returns.

It has been shown by research that over 90% of unpredictability in a portfolio can be overseen by asset allocation and not going after one asset class like equity or debt.

There is wide change in returns, consistently, in the different asset classes like domestic equity, international equity, gold, and less significantly in the debt. In some years, equity gives exceptional returns and in specific years the profits are negative. The equivalent is the situation with gold. The best way to smoothen out the effect of the unpredictability in these different ventures is to focus on allocation and earn ideal returns.

Now the question arises, how to execute the allocation ??

In the first place, you can do asset allocation without anyone’s help by putting money into equity, bonds, gold and so on, or put money into mutual funds. In mutual funds, there are different classifications of assets like equity, debt, hybrid (blend of equity and debt), and so on and you can put investments into those.

One more approach to doing it is, to invest in funds that diversify into various asset classes i.e, multi asset funds.

The benefit of doing your allocation through multi-asset reserves is the flexibility to different assets in a similar fund. The fluctuating performance of equity, debt, gold, and so forth balance out one another, and the fund conveys ideal returns.

According to guidelines, a multi-asset fund must have a portion to no less than three asset classes and have at least 10% distribution to every class.

Benefits

- Better returns during times of market volatility

- Asset allocation benefit

- Benefits of all assets in one fund

- Taxation benefit, as these are taxed as equity mutual funds.

- Professionally managed funds

Tip to invest

You should take care that the asset proportion of the fund should match your risk profile and investment goals.

Some of the best multi asset funds for 2022 are:

ICICI Prudential Multi Asset Fund

Aditya Birla Sun Life Financial Planning FoF Aggressive Plan

SBI Multi Asset Allocation Fund

Want to know more ? Call or WhatsApp us at 9460825477