The RBI rate hike will put a bigger dent in the average Indian’s pocket: Calculate how much your EMI will rise.

To combat inflation, the Reserve Bank of India (RBI) raised the repo rate by 50 basis points to 4.90 percent on Wednesday. The decision also allows banks, mortgage lenders, and lending institutions to raise interest rates on all types of loans. When banks and lending institutions raise interest rates in response, existing and new borrowers will be forced to pay higher EMIs on their loans.

Today’s hike comes just 36 days after the last repo rate hike of 40 basis points in an off-cycle meeting of the six-member rate-setting panel, which signalled a shift in the RBI’s strategy by prioritising inflation over growth. The RBI Governor stated today in his address that the war in Ukraine has resulted in globalisation of inflation and that “our steps will be calibrated, focused on bringing inflation to target level.”

The benchmark lending rate has now reached a two-year high of 4.90 percent as a result of the latest increase. Banks and lending institutions have already raised interest rates on all types of loans after the RBI raised the repo rate on May 4, the first increase since August 2018. The stage is set for lenders to follow suit following today’s decision, as the cost of funds is bound to rise.

Let’s understand how the rate hike will impact your EMIs.

HOME LOAN

If you borrow Rs 25 lakh at 7.05 percent per annum for a term of 20 years and the interest rate is raised to 7.55 percent, your EMI will increase by Rs 758, from Rs 19,458 to Rs 20,216. The total interest payment would be Rs 23,51,918 as opposed to Rs 21,69,819 previously. The EMI for Rs 50 lakh will rise by Rs 1,518, from Rs 38,915 to Rs 40,433, and the total interest payable will be Rs 47,03,840.

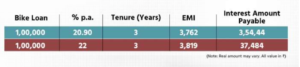

CAR & BIKE LOAN

Similarly, if the interest rate on a Rs 7.50 lakh auto loan increases from 9% to 10% over a 7-year period, the EMI will increase by Rs 400.

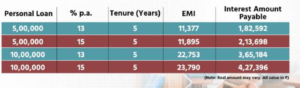

PERSONAL LOAN

Similarly, if a person takes out a personal loan of Rs 5 lakh at a rate of 13% per annum for a term of 5 years, the EMI would rise by Rs 518 from Rs 11,377 to Rs 11,895.

What Next?

To control inflation, regulatory bodies must control the flow of liquidity in the economy. Inflation has been above 6% for several months, which is above the RBI’s comfort level. Inflationary pressure, if not controlled, has the potential to destabilise growth. The two quick hikes indicate that the central bank is concerned about rising prices. The government has also used unconventional methods to combat inflation, such as cutting fuel taxes and limiting exports. However, there are no signs of inflation abating.

The government has tasked the central bank with maintaining retail inflation at 4% with a 2% margin of error on either side.

If you have any query feel free to contact us.