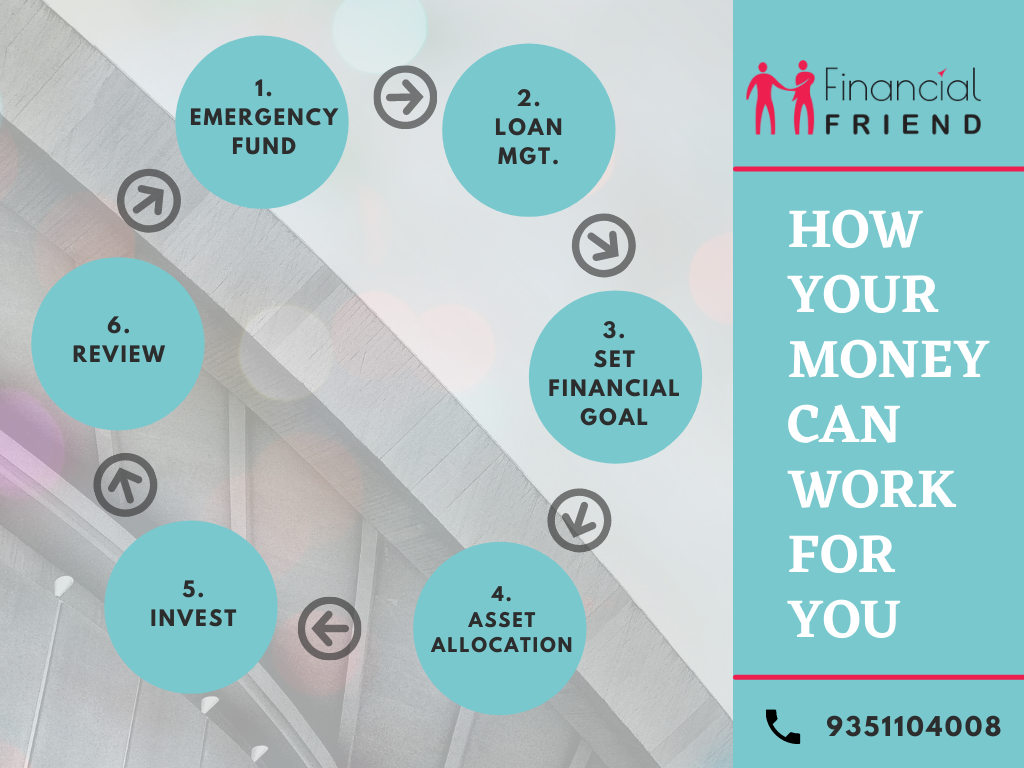

How your Money can work for you ? | Top 6 Ways

After earning money, it is equally important to know how wisely you should use that money.

Afterall, paisa hi paise ko kheichta hai… Right ?

But, in our busy lifestyles, we do not even bother to know more about where and how we can invest to earn more from our investments.

This thing may seem small at first. But, eventually, in the longer period of time like 10 yrs or so, we end up losing lakhs of money, by choosing wrong money management & investment strategy.

But, with our 10+ years of expertise in the finance industry, we have designed a step by step strategy which will help you with your wealth creation.

Here are the top 6 ways on how your money can work for you.

1. Create Emergency Fund : Before planning investments, it is important to keep aside some money for unforeseen emergencies. This fund may be equal to your 3 to 6 months expenses.

It is always good to have a term life insurance only for the earning member of the family & health insurance for all family members.

2. Loan Management – If we have heavy EMIs to pay, then these do not allow us to save money. So, it is important to pay the high-interest debt first. And, one should avoid these types of high-interest loans because if you calculate only the total interest part for the loan period, it would be even more than the principal amount. That is why loan management is very important.

3. Set Financial Goals – Every financial plan is incomplete without a goal. Your goal will define the type of strategy & the type of investment to be chosen.

4. Asset Allocation – You must have heard the popular saying, “Don’t put all your eggs in one basket”. Allocating your money to proper investment products will make you earn more with less risk. You can diversify your investments in mutual funds, stocks, gold, bonds, PPF, NSC, real estate etc.

5. Invest – After your portfolio is prepared with the correct asset allocation according to your financial goals, now it’s the time to get started & implement your planning.

6. Review Periodically – Reviewing your portfolio is highly recommended due to the dynamic nature of the finance industry. The Budget, the change in interest rates, economic changes etc. may affect your portfolio in some way. So, to keep your investments aligned with your goals, it is important to review them.

Making money from money is all about smart moves & correct strategy. Take the move as early as possible. For any help, contact Financial Friend.